Titan records 26% revenue growth in Q2 FY2024-25, profitability impacted

6th November 2024

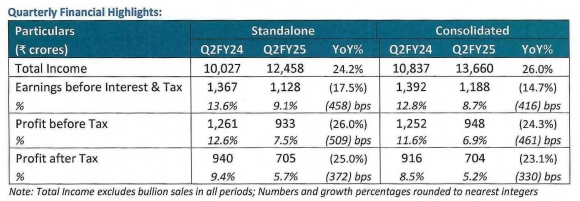

Titan Company Limited (“Titan”), announced its results today for the quarter and half year ended 30th September 2024. Titan (consolidated) recorded an income of 13,660 crores, which grew by 26% in Q2FY25 compared to Q2FY24. The PBT was lower by 24% at 948 crores compared to Q2FY24, mainly due to the impact of custom duty reduction.

Business Performance (Standalone)

Jewellery

Total quarterly income grew 26% over Q2FY24 to 10,763 crores. India’s business grew by 25% in the same period. EBIT at 932 crores came at a margin of 8.7% for the quarter. Normalising the custom duty impact, Q2FY25 EBIT came at 1,222 crores, clocking an 11.4% margin.

The custom duty reduction saw a revival in consumer interest as gold prices cooled off temporarily. The ensuing gold rush lasted well into mid-September. Buyer growth was healthy and well accompanied by an increase in average selling prices, both exhibiting double-digit growth. During the quarter, in India, Tanishq opened 11 new stores (net), Mia added 12, and Zoya added one store.

Watches & Wearables

Business recorded a total income of 1,301 crores, up 19% over Q2FY24. The domestic business grew 19% in the same period. EBIT came in at 194 crores, clocking a margin of 14.9% for the quarter.

The analogue segment recorded a strong 26% revenue growth over Q2FY24, led by the Titan brand’s 32% growth. Consumer preferences for premium brands were visible, with the Helios channel (international brand sales) clocking a healthy retail growth of 43% over Q2FY24. The wearables segment saw a 13% drop in revenue compared to Q2FY24, primarily due to a reduction in average selling prices. Thirty-four stores (net) were added in Q2FY25, comprising 18 new stores in Titan World, 14 in Helios, and 2 in Fastrack.

Eye Care

Total income of 201 crores in Q2FY25 grew by 7% over Q2FY24. The business recorded an EBIT of 24 crores, clocking a margin of 11.9% for the quarter. Frames and lenses saw healthy growth in volumes, while sunglasses recorded a volume decline due to seasonality. International brand sales recorded a strong growth of 53% over Q2FY24. Business increased its promotional activities, leading to a double-digit growth in advertising compared to the same period last year. The division added three new stores (net) during the quarter in Titan Eye+.

Emerging Businesses

The Emerging Businesses, comprising Indian Dress Wear (Taneira), Fragrances, and Fashion Accessories (F&FA), recorded a total income of 106 crores for Q2FY25, growing 14% over Q2FY24. Taneira’s sales grew 12%, driven mainly by growth from new stores. The brand opened four new stores during the quarter, taking the total store count to 81 across 41 cities. The F&FA business grew 16% over Q2FY24 (excluding the discontinued belts and wallets sub-segment, comparable growth was 33%). Within sub-segments, Fragrances (SKINN) grew 19%, and Women’s Bags (IRTH & Fastrack) grew 76% over Q2FY24. The emerging businesses recorded a loss of 29 crores for the quarter.

International Business Performance (Consolidated)

The International Jewellery business recorded an income growth of 62% to 273 crores compared to Q2FY24. Other businesses, primarily analog watches, grew 54% over Q2FY24. During the quarter, Mia opened a new store in Abu Dhabi, with the international footprint for Jewellery reaching 18 stores, consisting of 16 Tanishq stores and 2 Mia stores.

Key Subsidiaries of the Company:

Caratlane Trading Private Limited

Total income grew 28% to 829 crores compared to Q2FY24 (excluding bullion and digi-gold sales). Activations in July and August 2024 spurred growth in new customer acquisition by 21% and brand search growth by 30% over their respective Q2FY24 values. EBIT came in at 58 crores for Q2FY25, clocking a margin of 7.0%. Caratlane added 11 new stores (net) in the quarter, bringing the total to 286 stores across 119 cities in India.

Titan Engineering & Automation Limited

The business recorded a total income of 196 crores in Q2FY25, a growth of 56% compared to Q2FY24. Within divisions, the Automation Solutions (AS) business grew by 89%, and the Manufacturing Services business grew 24% over Q2FY24. EBIT for the quarter came in at 25 crores, clocking a margin of 12.8%.

Managing Director’s Statement

Mr CK Venkataraman, Managing Director of the Company, stated: “After a muted Q1, Q2 witnessed encouraging growth across key businesses. Jewellery clocked healthy double-digit growth for the quarter. Our portfolio approach in this business of straddling diverse customer needs through the brands of Tanishq, Mia, Zoya, and Caratlane is working well. The buyer growth metrics were strong and in good double-digits across gold and studded product categories. The quarter also witnessed analog watches growing 25%+ over last year with a commensurate uptick in volumes. Titan brand continues to be Indian consumers’ proud choice in this segment. On account of the customs duty-related losses, as well as the need to invest in the growth of various businesses, the profitability of Q2 was quite depressed. However, we are confident about the competitiveness of each of our businesses and remain optimistic about our performance for the rest of the financial year.”