THE INDIAN JEWELLERY MARKET HAS GROWN FROM USD 50 BILLION IN FY18 TO USD 80 BILLION IN FY24 – MOTILAL OSWAL FINANCIAL SERVICES

19th June 2024

Motilal Oswal Financial Services Ltd suggest that the size of the Indian jewellery retail sector was close to USD 80 Billion (INR 6,400 Billion) in FY24. There are multiple drivers in the industry leading to such rapid growth, driven by rising disposable income (higher per capita growth in double digits), an improving mix for regular wear (beyond weddings and investment-led), enhanced product offerings (design, diamonds, etc.), trust-building through hallmarking, and a better buying experience at organized retail outlets Within this landscape, organized retail accounted for about 36-38% and comprised both pan-India and regional players.

India’s gold supply is dominated by imports

The gold market experienced notable fluctuations in imports from FY18 to FY20, reaching 980 tonnes in FY19 before declining to 720 tonnes in FY20. This volatility was led by various factors, including declines in global gold prices, buoyant economic conditions leading to heightened disposable incomes, and substantial demand for gold due to traditional celebrations and weddings. However, in FY20, a significant drop occurred due to escalating import duties and the initial stages of an economic slowdown.

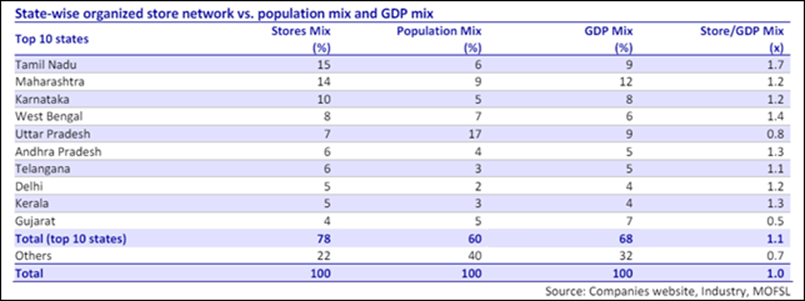

Top 10 states contribute 78% of the organized retail network

We captured the store locator for top 18 organized retailers to analyse the state level competitive landscape and market mix of each player. The top 10 states contribute 78% of the organized retail network of over 2,000 stores. These states contribute 60% of the total population and 68% of the GDP. Tamil Nadu, Maharashtra, Karnataka, West Bengal, and Uttar Pradesh are the top 5 states with a store mix of 15%, 14%, 10%, 8% and 7%, respectively.

Gold consumption patterns in India:

Jewellery for occasions

Weddings and festivals are the primary reasons for the purchase of jewellery in India. Bridal jewellery still accounts for a significant portion of demand, contributing 55% to the total jewellery demand. Daily wear jewellery accounts for 30-35% of the Indian jewellery market. Players are strategically focusing on manufacturing lightweight pieces to cater to the preferences of younger consumers, especially those who desire daily wear gold jewellery that complements western-style attire. Fashion jewellery, on the other hand, contributes nearly 10% to the Indian jewellery market.

Jewellery by product category Bangles and chains are the primary contributors to domestic jewellery consumption, accounting for 60-70% of total sales. These are preferred as daily wear by women. Necklaces contribute around 15-20% to the sales volume, with their sales surging during special occasions, such as festivals and weddings. The remaining 5-15% of sales is attributed to rings and earrings.