SECOND-QUARTER GOLD DEMAND HITS RECORD HIGHS, SUPPORTING RISING PRICES

31st July 2024

The World Gold Council’s Q2 2024 Gold Demand Trends report reveals that total global gold demand increased 4% year-on-year to 1,258t, marking the strongest Q2 in our data series1. Total demand was supported by healthy over-the-counter (OTC2) transactions, up a notable 53% year-on-year at 329t.

Global Gold Demand

The World Gold Council’s Q2 2024 Gold Demand Trends report reveals that total global gold demand increased 4% year-on-year to 1,258t, marking the strongest Q2 in our data series. Total demand was supported by healthy over-the-counter (OTC) transactions, up a notable 53% year-on-year at 329t.

Price Trends

Increased OTC demand, continued buying from central banks, and a slowdown in ETF outflows drove record-high gold prices in Q2. The gold price averaged USD 2,338/oz., 18% higher year-on-year, reaching a record of USD 2,427/oz. during the quarter.

Central Bank Activity

Central banks and official institutions increased global gold holdings by 183t, slowing down from the previous quarter but still reflecting a 6% increase year-on-year. Our annual central bank survey confirmed that reserve managers believe gold allocations will continue to rise over the next 12 months, driven by the need for portfolio protection and diversification in a complex economic and geopolitical environment.

Investment Trends

Global gold investment remained resilient, marginally higher year-on-year at 254t, concealing divergent demand trends. Bar and coin investment decreased 5% to 261t in Q2, due to a sharp decline in demand for gold coins. Strong retail investment in Asia was counterbalanced by lower levels of net demand in Europe and North America, where profit-taking surged in some markets.

ETF Activity

Global gold ETFs saw minor outflows of 7t during the quarter. Asian growth continued, sizable European outflows in April turned into nascent inflows in May and June, and North American outflows slowed significantly compared to the previous quarter.

Jewellery Demand

Record high prices drove down jewellery demand by 19% year-on-year in Q2, but H1 demand remains resilient compared to the same period last year, thanks to a stronger-than-expected first quarter.

Technology Demand

In addition, demand for gold in technology continued to increase, jumping 11% year-on-year driven primarily by the AI boom in the electronics sector which saw an increase of 14% year-on-year.

Supply Trends

Total gold supply rose 4% year-on-year, with mine production increasing to 929t. Recycled gold volumes increased 4% compared to the same quarter in 2023, marking the highest second quarter since 2012.

Analyst Comments

Louise Street, Senior Markets Analyst at the World Gold Council, commented: “The rising and record-breaking gold price has made headlines as strong demand from central banks and the OTC market supported prices, which has been a consistent trend throughout the year. The OTC market has seen continued appetite for gold from institutional and high-net-worth investors, as well as family offices, as they turn to gold for portfolio diversification. On the other hand, demand from jewellery tumbled last quarter as prices continued to hit highs, which also tempted some retail investors to take profit.

“Looking ahead, the question is: what will be the catalyst to keep gold front and centre in investment strategies? With a long-awaited rate cut from the US Fed on the horizon, inflows into gold ETFs have increased thanks to renewed interest from Western investors. A sustained revival of investment from this group could change demand dynamics in the second half of 2024. In India, the recently announced import duty cut should create positive conditions for gold demand, where high prices have hampered consumer buying.

“While there are potential headwinds for gold ahead, there are also changes taking place in the global market that should support and elevate gold demand.”

Gold demand excluding OTC in Q2 was down 6% y/y to 929t as a sharp decline in jewellery consumption outweighed mild gains in all other sectors.

Over-the-counter (OTC) transactions (also referred to as ‘off exchange’ trading) takes place directly between two parties, unlike exchange trading which is conducted via an exchange.

India Gold Demand Statistics for Q2 2024 (April – June)

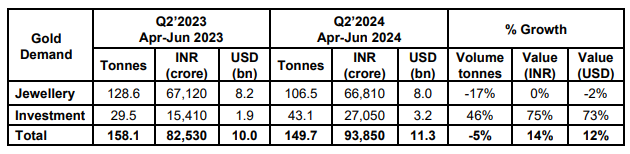

- Demand for gold in India for Q2 2024 was at 149.7 tonnes, down by 5% as compared to overall Q2 demand for 2023 (158.1 tonnes)

o India’s Q2 2024 gold demand value was INR 93,850 crores, up by 14% as compared to Q2 2023 (INR 82,530 crores)

- Total Jewellery demand in India for Q2 2024 decreased by 17% to 106.5 tonnes as compared to Q2 2023 (128.6 tonnes)

o The value of jewellery demand was INR 66,810 crores, marginally down from INR 67,120 crores recorded in Q2 2023

- Total Investment demand for Q2 2024 at 43.1 tonnes increased by 46% in comparison to Q2 2023 (29.5 tonnes)

o In value terms, gold Investment demand in Q2 2024 was INR 27,050 crores, up by 75% from Q2 2023 (INR 15,410 crores)

- Total gold recycled in India in Q2 2024 was 23 tonnes, down by 39% compared to 37.6 tonnes in Q2 2023

- Total gold imports in India in Q2 2024 was 196.9 tonnes, up by 8% compared to 182.3 tonnes in Q2 2023

- USD/oz average quarterly price in Q2 2024 was USD 2,338.2 in comparison to USD 1,975.9 in Q2 2023

• INR/10g average quarterly price in Q2 2024 was INR 62,700.5 in comparison to INR 52,191.6 in Q2 2023 (without import duty and GST)

India gold demand figures for the period April – June 2024 vs. the corresponding period in 2023:

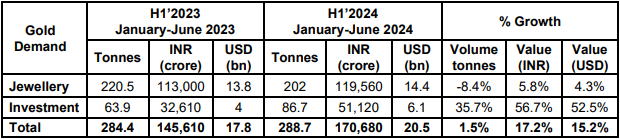

India gold demand figures for the period January – June 2024 vs. the corresponding period in 2023:

Regional Focus: India

Sachin Jain, Regional CEO, India, World Gold Council said: “India’s gold demand softened slightly in Q2 2024, reaching 149.7 tonnes, down 5% year-on-year. This can be attributed to record-high gold prices impacting affordability and causing a slowdown in consumer purchases. However, the overall value of demand remained strong, increasing by 14%, highlighting gold’s enduring value for Indian consumers. Jewellery demand felt the pressure of high prices, declining 17% to 107 tonnes due to high local prices, the general election and a severe heatwave. While festivals like Akshaya Tritiya and Gudi Padwa provided a temporary boost, record-high prices continued to dampen consumer sentiment. Conversely, Investment demand surged by 46% to 43.1 tonnes, its highest second-quarter level since 2014 driven by expectations of further price appreciation and safe-haven buying.

Bucking global trends, India’s gold recycling fell 39% to 23 tonnes, as consumers, rather than cashing in, opted for an exchange of old jewellery for new. This indicates limited distress selling and points to highlighting gold’s enduring role as a store of value in India. Looking ahead, the recent 9% reduction in import duty on gold is expected to revive the gold demand in July quarter ahead of the main festive season that begins in September, which could be further boosted by a healthy monsoon. India’s economic outlook too remains positive, with strong GDP forecasts and rural sector recovery are all likely to support demand in the second half of the year. Our forecast for full-year demand is between 700 to 750 tonnes.”