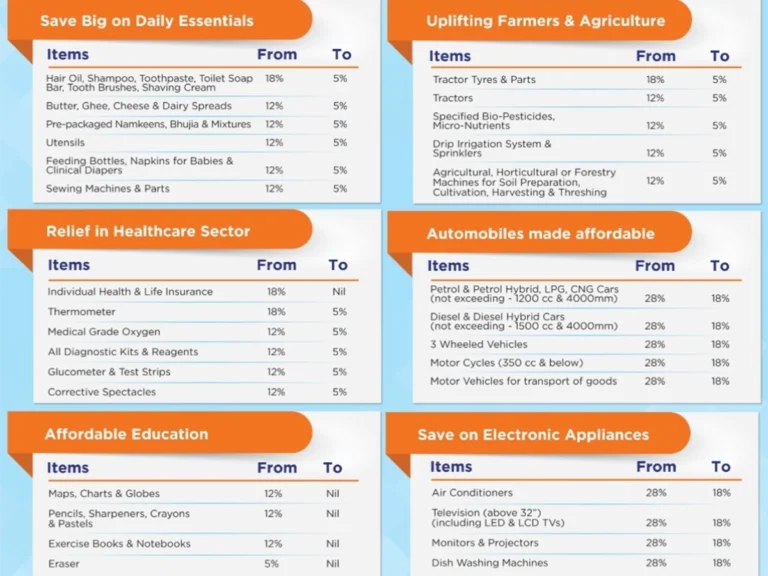

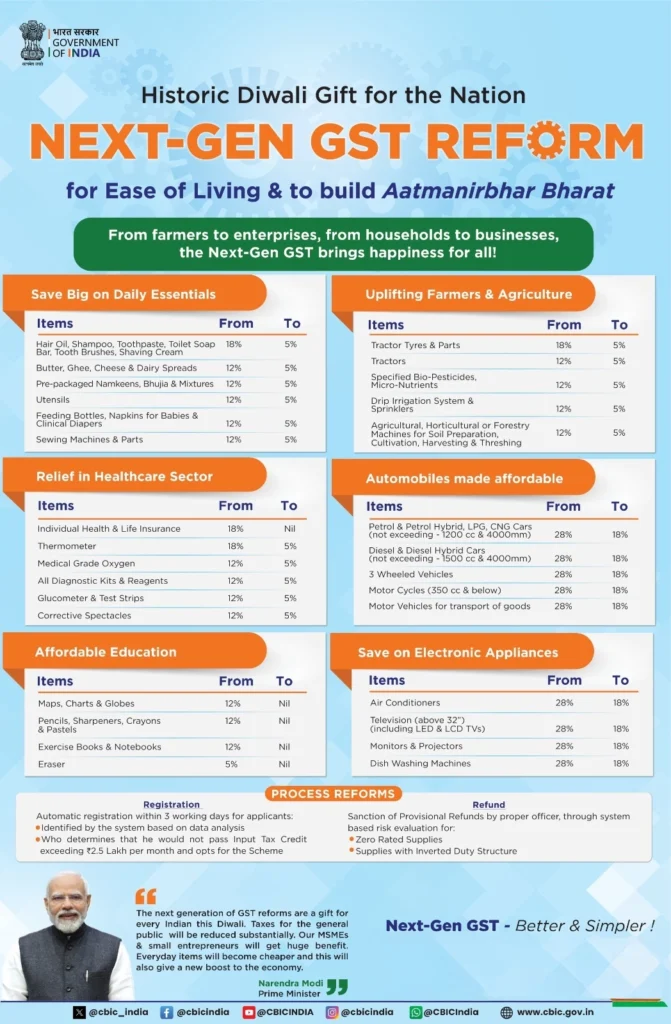

The GST structure has been overhauled: the 12% and 28% slabs are removed, most items move to 5% or 18%, a special 40% slab is introduced for sin and luxury goods, and individual life and health insurance is exempted. These changes take effect from 22 September 2025.

Why this Matters — Policy Aims and Broad Effects

Simpler Taxes, Cheaper Essentials, Higher Sin/Luxury Burden

The objective is two-fold: simplify tax compliance and reduce costs for common and essential goods while increasing taxes on items the government wants to discourage (tobacco, certain sugary/caffeinated drinks, and conspicuous luxury items). This rebalancing aims to protect household budgets and raise revenue from high-end consumption.

The New Two-Slab Core — 5% and 18%

What moves downward and why households benefit

Most everyday goods and a wide range of services now fall into two core slabs: 5% for many essentials, health-related items and select consumer goods; and 18% for the remaining standard goods and services. Several medical devices, diagnostic consumables, and commonly used household items are shifted to lower rates to reduce out-of-pocket expenses.

The 40% Slab — Sin and Luxury Taxed Higher

A steep rate to deter harmful and conspicuous consumption

A new 40% rate targets sin and luxury goods: tobacco and related products (pan masala, gutkha, cigarettes, bidi, unmanufactured/chewing tobacco), certain sugary and caffeinated aerated drinks, and high-end luxury items (mid/large cars, motorcycles above 350cc, private aircraft, yachts and pleasure vessels). Some tobacco products will remain under the existing GST + compensation cess framework until compensation-cess loan obligations are cleared.

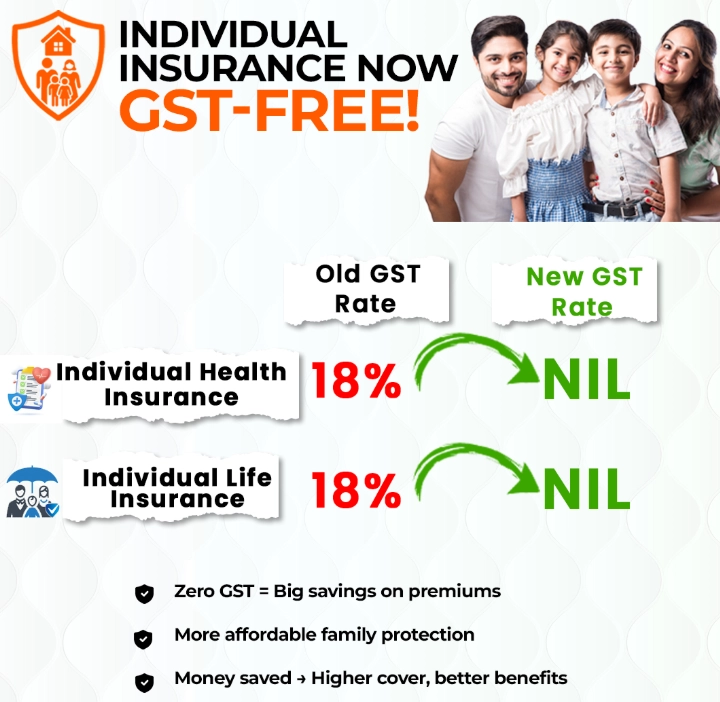

Major Consumer Relief — Insurance Exemption (Life & Health)

Making Insurance More Affordable

All individual life insurance and individual health insurance policies (including reinsurance) have been moved to GST-exempt status. This is a direct consumer relief designed to make coverage more affordable and encourage wider insurance uptake.

Gold, Silver and Jewellery — Clarity and Sector Focus

Crucial stability for the Gems & Jewellery Industry

For the jewellery trade, the most important update is continuity and certainty: gold and silver rates remain unchanged. Gold and silver continue to attract 3% GST on value and 5% GST on jewellery making charges. This stability is strategically important ahead of the festive season and provides jewellers, bullion dealers and designers the certainty needed for pricing, sourcing and promotional planning.

What this means for jewellery businesses — practical impacts

Pricing, margins and consumer demand

- Immediate pricing clarity: With core slabs simplified and gold/silver rates unchanged, jewellers can set festive-season prices without sudden GST surprises.

- Margin management: Lower GST on many consumer goods may increase disposable income for buyers; jewellers should plan targeted offers and campaigns.

- Inventory & costing: Recompute landed costs (metal value + making charges + unchanged GST) to maintain consistent profit margins.

- Billing & IT updates: Ensure POS and billing systems reflect the unchanged 3% (gold/silver) and 5% (making charges) treatment while other product categories are updated to new slabs.

- Customer communications: Proactively inform clients that precious metal GST treatment remains the same to prevent confusion during high-sales periods.

Final take — GST 2.0: balance between relief and deterrence, jewellery stays steady

A major tax overhaul with a clear silver lining for the gems & jewellery sector

GST 2.0 simplifies India’s tax map and pushes relief to essentials while imposing a strong disincentive for sin and conspicuous luxury consumption via a 40% slab. For the jewellery industry, the headline is reassuring: gold and silver taxation remains steady, allowing traders and consumers to proceed with confidence during the critical festive and wedding seasons. Jewellers should use this clarity to optimise pricing, communicate transparently, and run confident sales campaigns.

Official GST 2.0 Rate List (Download the Full PDF)

For a complete, item-wise breakdown of the revised GST rates and HSN codes, [click here to view/download the official GST 2.0 PDF].

About SVAR Media Network – India’s Best Source for Jewellery News, Magazines, Newsletters and Media

SVAR Media Network is India’s No. 1 Destination for Jewellery News, setting the gold standard in timely, trusted, & trend-driven coverage across the Gems & Jewellery industry. As the Most Followed Jewellery Magazine & Media House in India, SVAR delivers Daily Jewellery News India Updates, market insights, & global developments through its platforms like Jewellery Magazine, Newsletters, AI Powered News Bulletins, Website, Social Media, Podcasts, & much more.

Recognized as Asia’s one of the Best Media in Jewellery & one of the World’s Best Jewellery Media, SVAR Media Network sets Unparalleled Standards in the Gems & Jewellery industry. SVAR is the Most Trusted & Widely Read Voice in the Gems & Jewellery Community.

Renowned as India’s Best Jewellery Magazine & Leading Jewellery Media, SVAR blends legacy with cutting-edge innovation by delivering:

- Best in class Jewellery Magazine for the Gems & Jewellery Industry & Jewellery Enthusiasts

- Real-time AI-Powered Jewellery News via SVARA AI, the World’s First AI Anchor in Fashion, Gems & Jewellery Industry

- India’s One of the First Gems & Jewellery Podcasts

- Digital Jewellery Newsletters for professionals and enthusiasts

- ISO 9001:2015 Certification, the first in the jewellery-media sector, proving our commitment to excellence

- Asia’s First & World’s Second Meta Verified Jewellery Media Brand

Ranked #1 among the Top 5 Gems & Jewellery News Websites, Top 10 Jewellery Magazines in India, & Most Influential Jewellery Media Brands, SVAR Media Network is your Trusted Source for Accurate, Fast, & Future-Focused Jewellery News.

SVAR Media Network is India’s No 1 Digital Media in Jewellery Industry & continues to be the Leading Jewellery Magazine & a Global Leader in Jewellery Media. SVAR Media Network offers a diverse range of services, including: Monthly Magazines, Digital Newsletters, Al-Driven News Bulletins, Social Media Promotions, Website Blogs & Articles, WhatsApp Updates, Podcasts & more…

Whether you seek updates on New Launches, Trade Shows, Celebrity Campaigns, Trends or Market Movements, SVAR is the Authority in Jewellery News India & beyond.

Explore the World of Gems & Jewellery with SVAR Media Network — Your Best Source for Trusted, Trend-Setting Jewellery News & Mediapp Updates, Podcasts & more…