India’s natural diamond polishing industry faces a steep 28-30% fall in revenues to ~$12.50 billion this fiscal, compared with $16 billion last fiscal, after the imposition of 50% tariffs (25% reciprocal plus 25% penalty) by the US. The blow will follow a ~40% degrowth over the past three fiscals because of a fall in both prices and sales volume of natural diamonds as demand in the US and China dropped, and competition from lab-grown diamonds rose.

Impact of US Tariffs on Exports

The 50% tariffs, effective this week, makes exports to the US tough for two reasons: one, the industry’s low margins make absorption of the incremental levy very difficult and two, declining demand means passing on the incremental burden to consumers will not be easy. The consequent reduced operating leverage could erode the operating margin of diamond polishers by 50-100 basis points and pressurise their credit profiles. Our analysis of 43 diamond polishers, accounting for nearly a fourth of the industry’s revenues, indicates as much.

US Market Share Declines Amid Tariffs

The Indian polished diamond industry derives 80% of its revenues from exports while the US is a key market for India and accounted for as much as 35% of its exports. Sales had begun getting impacted after a 10% tariff was imposed in April 2025. Hence, the share of the US in India’s polished natural diamonds slid 1100 basis points in the first four months of this fiscal to 24%.

Production Surge Before US Festival Season

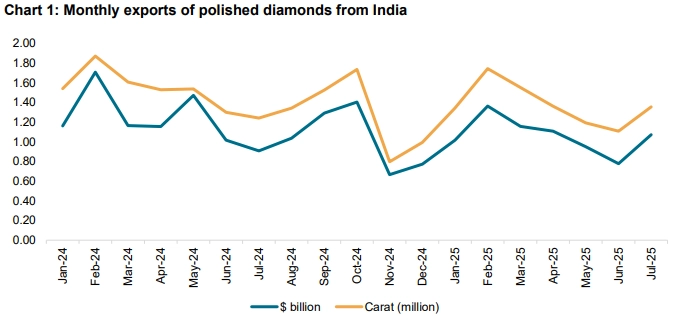

But in a proactive move, diamond polishers had cranked up production in July and August to meet the anticipated festival demand in the US. Not surprisingly, exports surged 18% in July on-year (see Chart 1). And competition from lab-grown diamonds in markets such as the US will continue to dent revenues, with the variety having already captured ~60% of the market share by volume. Subdued Chinese demand adds to these woes.

Industry Experts Warn of Revenue Lows

Says Rahul Guha, Senior Director, Crisil Ratings, “The upshot is that revenues for the domestic industry, which polishes ~95% of all diamonds produced in the world, is set to drop to its lowest since 2007. To be sure, consumption in India has been increasing sequentially over the years, but the incremental demand doesn’t have the heft to fully offset the losses in the US and China. Additionally, while the UAE has emerged as a dominant hub for India’s exports with its share doubling to ~20%, on year, the risks of a substantial downturn in revenues are high.”

Strategic Steps Needed for Diamond Polishers

The industry’s ability to navigate the market dynamics, including tariffs, is crucial to its future. Diamond polishers can take three steps: increase domestic sales; push sales in alternative geographies; and set up polishing facilities in trading hubs as rerouting via low-tariff nations is not an option. Even if retailers explore alternative sourcing options in lower-tariff countries such as the UAE or Belgium, a significant portion of the diamonds would still be polished in India and thus subject to higher tariff.

Margin Pressure for Diamond Polishers

And given the falling demand, US retailers are unlikely to absorb the tariff cost. Hence, operating margins of diamond polishers would decline to 3.5-4.0% after dropping 100 bps in the past three fiscals from a peak of 5.5% in fiscal 2023. Diamond polishers are expected to keep a lean inventory to control debt. Miners have cut production to limit the fall in prices, in line with subdued demand. Timely collection from customers abroad will be monitorable amid slowing demand. Debt levels of diamond polishers should reduce over the medium term.

Credit Profile Challenges Ahead

Says Himank Sharma, Director, Crisil Ratings, “While limited reliance on external debt has helped diamond polishers maintain a stable capital structure, declining scale of operations and pressure on profitability will likely test their credit risk profiles. Specifically, while the financial leverage is expected to be relatively stable at 0.7-0.8 time, the interest coverage could decline to ~2 times from 2.3-2.5 times last fiscal.”

The Road Ahead for India’s Diamond Industry

In the road ahead, demand for natural diamonds in key markets will need close monitoring, given the tariff landscape and geopolitical uncertainties.

About Crisil Ratings Limited

Crisil Ratings pioneered the concept of credit rating in India in 1987. With a tradition of independence, analytical rigour and innovation, we set the standards in the credit rating business. We rate the entire range of debt instruments, such as, bank loans, certificates of deposit, commercial paper, nonconvertible / convertible / partially convertible bonds and debentures, perpetual bonds, bank hybrid capital instruments, asset-backed and mortgagebacked securities, partial guarantees and other structured debt instruments. We have rated over 35,000 large and mid-scale corporates and financial institutions. We have also instituted several innovations in India in the rating business, including rating municipal bonds, partially guaranteed instruments and infrastructure investment trusts (InvITs). Crisil Ratings Limited (“Crisil Ratings”) is a wholly-owned subsidiary of Crisil Limited (“Crisil”). Crisil Ratings Limited is registered in India as a credit rating agency with the Securities and Exchange Board of India (“SEBI”). For more information, visit CrisilRatings.com.

About Crisil

Crisil is a global, insights-driven analytics company. Our extraordinary domain expertise and analytical rigour help clients make mission-critical decisions with confidence. Large and highly respected firms partner with us for the most reliable opinions on risk in India, and for uncovering powerful insights and turning risks into opportunities globally. We are integral to multiplying their opportunities and success. Headquartered in India, Crisil is majority owned by S&P Global. Founded in 1987 as India’s first credit rating agency, our expertise today extends across businesses: Crisil Ratings, Crisil Intelligence, Crisil Coalition Greenwich and Crisil Integral IQ. Crisil’s global expertise strengthens industry analysis and provides a reliable foundation for future insights.

About SVAR Media Network – India’s Best Source for Jewellery News, Magazines, Newsletters and Media

SVAR Media Network is India’s No. 1 Destination for Jewellery News, setting the gold standard in timely, trusted, & trend-driven coverage across the Gems & Jewellery industry. As the Most Followed Jewellery Magazine & Media House in India, SVAR delivers Daily Jewellery News India Updates, market insights, & global developments through its platforms like Jewellery Magazine, Newsletters, AI Powered News Bulletins, Website, Social Media, Podcasts, & much more.

Recognized as Asia’s one of the Best Media in Jewellery & one of the World’s Best Jewellery Media, SVAR Media Network sets Unparalleled Standards in the Gems & Jewellery industry. SVAR is the Most Trusted & Widely Read Voice in the Gems & Jewellery Community.

Renowned as India’s Best Jewellery Magazine & Leading Jewellery Media, SVAR blends legacy with cutting-edge innovation by delivering:

- Best in class Jewellery Magazine for the Gems & Jewellery Industry & Jewellery Enthusiasts

- Real-time AI-Powered Jewellery News via SVARA AI, the World’s First AI Anchor in Fashion, Gems & Jewellery Industry

- India’s One of the First Gems & Jewellery Podcasts

- Digital Jewellery Newsletters for professionals and enthusiasts

- ISO 9001:2015 Certification, the first in the jewellery-media sector, proving our commitment to excellence

- Asia’s First & World’s Second Meta Verified Jewellery Media Brand

Ranked #1 among the Top 5 Gems & Jewellery News Websites, Top 10 Jewellery Magazines in India, & Most Influential Jewellery Media Brands, SVAR Media Network is your Trusted Source for Accurate, Fast, & Future-Focused Jewellery News.

SVAR Media Network is India’s No 1 Digital Media in Jewellery Industry & continues to be the Leading Jewellery Magazine & a Global Leader in Jewellery Media. SVAR Media Network offers a diverse range of services, including: Monthly Magazines, Digital Newsletters, Al-Driven News Bulletins, Social Media Promotions, Website Blogs & Articles, WhatsApp Updates, Podcasts & more…

Whether you seek updates on New Launches, Trade Shows, Celebrity Campaigns, Trends or Market Movements, SVAR is the Authority in Jewellery News India & beyond.

Explore the World of Gems & Jewellery with SVAR Media Network — Your Best Source for Trusted, Trend-Setting Jewellery News & Mediapp Updates, Podcasts & more…