Trump Pauses Tariffs for 90 Days, Then Slaps China with 125% Duties: India Stands to Gain as Global Markets Soar, Gold Jumps 3.7%

Trump’s Shock Move on Trade Policy Sends Markets into a Frenzy

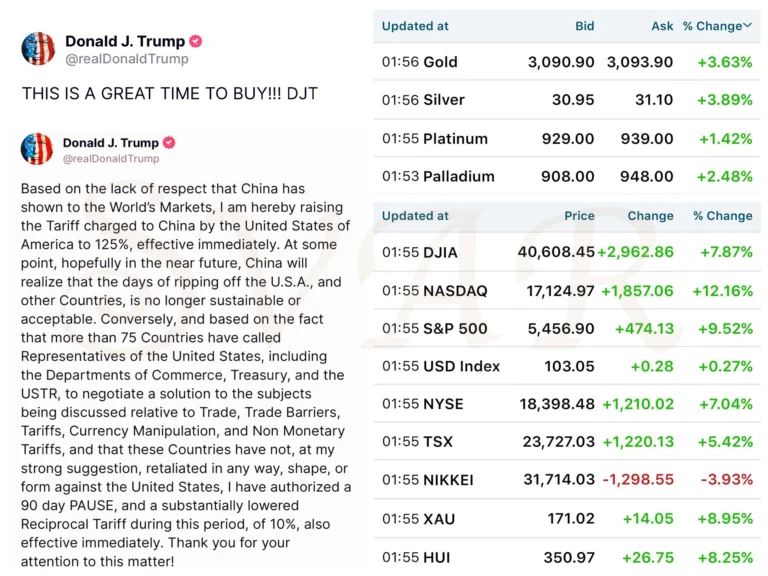

In a dramatic sequence of posts that shook global markets, U.S. President Donald Trump first declared on Truth Social at 7:07 PM IST (9:37 AM ET) that it was a “great time to buy”, sending early signals of a shift in U.S. trade policy.

A Dual-Tone Announcement: Relief for Some, Penalty for China

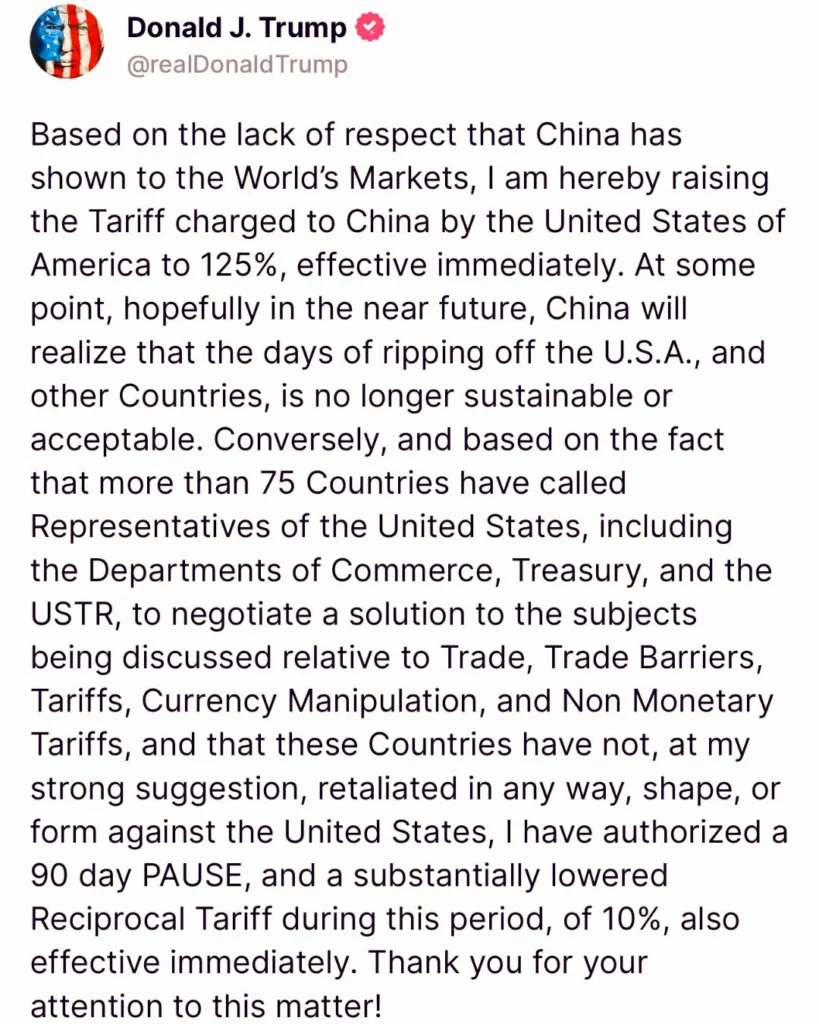

A few hours later, at 10:48 PM IST (1:18 PM ET), Trump followed up with a game-changing announcement: a 90-day pause on reciprocal tariffs for all countries that have not retaliated against the United States, including India, with a reduced tariff of just 10% during this period.

China Hit Hard Amid Accusations of Market Disrespect

However, the softer stance did not extend to China. In the same post, Trump raised tariffs on Chinese imports from the recently increased 104% to a whopping 125%, effective immediately, citing a “lack of respect” from China toward global markets.

The Timeline: From Hint to Hammer

Here’s how April 9 unfolded:

- An immediate hike in Chinese tariffs to 125%

- Earlier: The U.S. had already increased tariffs on China from 54% to 104%.

- China retaliated with an 84% tariff on all U.S. imports, rejecting what it called “tax blackmail.”

- 7:07 PM IST: Trump posted “Great time to buy!”, interpreted by markets as a bullish hint.

- 10:48 PM IST: Trump announced:

- A 90-day tariff pause for countries that did not retaliate (like India)

- A 10% reciprocal tariff for those countries during the pause

Trump’s Official Truth Social Statement (10:48 PM IST)

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately. At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.

Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR… and that these Countries have not, at my strong suggestion, retaliated in any way… I have authorized a 90-day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

India Stands to Gain: Strategic Silence Pays Off

Since the Indian stock market was closed when Trump made these announcements, the reaction is yet to be seen. However, India stands to benefit significantly as a non-retaliating nation:

- India now enjoys reduced 10% reciprocal tariffs during the 90-day window

- It may fill export gaps left by Chinese goods, especially in sectors like jewellery, electronics, and pharmaceuticals

- The move strengthens India-U.S. trade ties at a crucial time

Market participants expect a positive opening when Indian markets resume trading.

Global Markets Surge: Relief Rally Takes Over

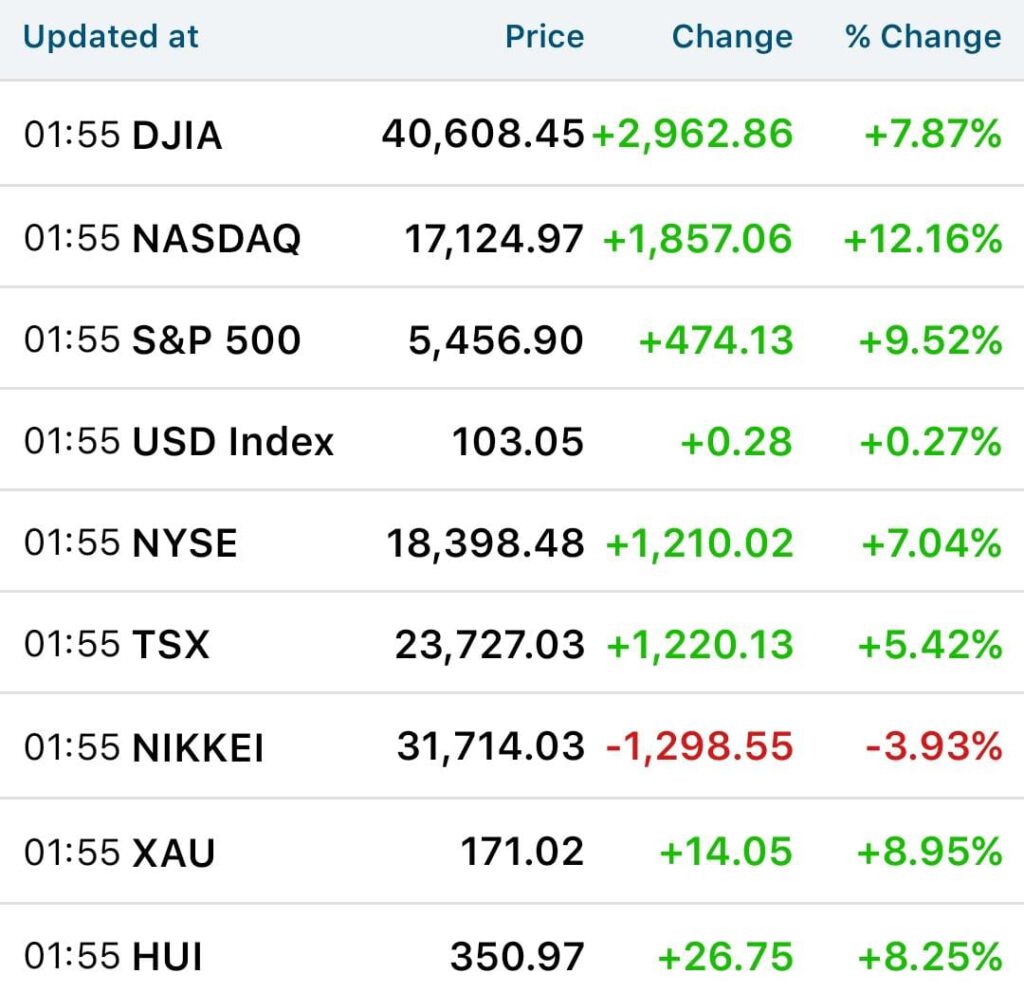

Trump’s twin posts triggered a massive relief rally across global financial markets. As of midnight IST:

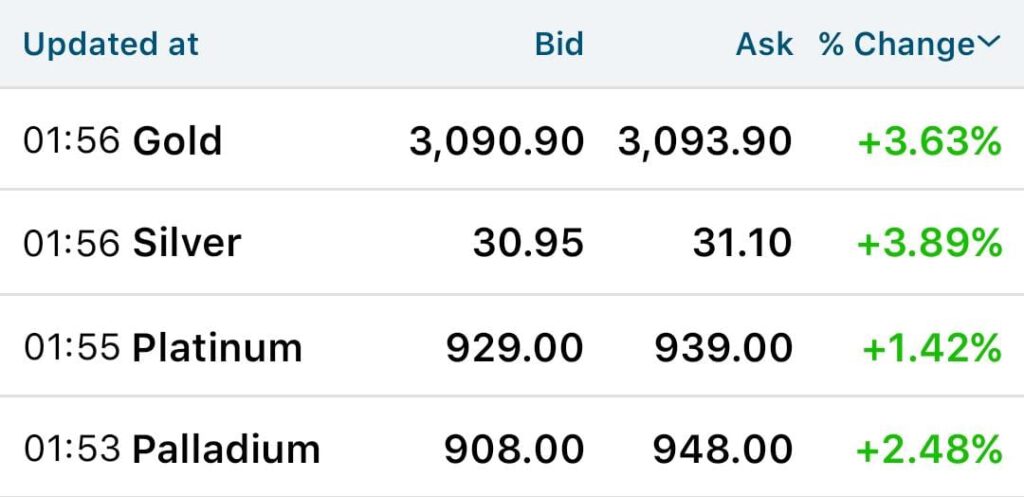

- Gold alone surged 3.7%

- Dow Jones: +2,728.97 points (+7.25%) to 40,374.56

- Nasdaq Composite: +10.73% to 16,905.97

- S&P 500: +8.29% to 5,395.20

- Crude Oil: +6%

- Copper & Natural Gas: +8%

- Silver & Gold: +3%

Gold Soars 3.7%: India Watches Closely

Gold prices surged 3.7% globally amid heightened trade tensions and a broader market rally. As one of the world’s largest gold consumers, India will be observing the trend with interest.

While the immediate impact on domestic markets remains to be seen, jewellers, bullion traders, and investors are likely to monitor global cues and price movements closely in the coming days.

Oil Prices Recover as Trade War Cools—Except with China

After dipping below $60, Brent crude jumped to nearly $65 a barrel, while WTI crude moved above $61.

“A relief rally in broader markets is dragging crude higher, but the pause on other countries is far less impactful when tariffs on China are up,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Group.

China remains a key driver of crude demand, so the tariff escalation could still pose risks.

Conclusion: Strategic Diplomacy Rewards India, Market Awaits Reaction

Trump’s April 9 messaging—from “great time to buy” to the 90-day tariff pause and the 125% China duty—has rewritten the current chapter of the trade war.

With India maintaining diplomatic silence and not retaliating, it has emerged as a potential winner—but how Indian markets and industries respond when trading resumes will reveal the true impact of these moves.

About SVAR Media Network:

SVAR Media Network, India’s Best Magazine & Media in Jewellery, stands as the Most Followed Jewellery Magazine & Media House in India. Recognized as Asia’s one of the Best Media in Jewellery & one of the World’s Best Jewellery Media, SVAR Media Network sets Unparalleled Standards in the Gems & Jewellery industry. Proudly holding the prestigious ISO 9001:2015 Certification, SVAR Media is the First Media Brand in the Gems & Jewellery industry to achieve this milestone, showcasing its commitment to operational excellence.

Pioneering innovations include the launch of the World’s First AI Anchor in Fashion, Gems & Jewellery with SVARA AI, India’s One of the First Gems & Jewellery Podcast, Asia’s First Meta Verified Media, the World’s Second, India’s 1st Meta Verified Media in the industry. SVAR Media Network is India’s No 1 Digital Media & continues to be the Leading Jewellery Magazine & a Global Leader in Jewellery Media

SVAR Media Network offers a diverse range of services, including: Monthly Magazines, Digital Newsletters, Al-Driven News Bulletins, Social Media Promotions, Website Blogs and Articles, WhatsApp Updates, Podcasts & more…